The “Holy Grail” of Investing

So, let’s talk about Ray Dalio and the “Holy Grail” of investing.

For anyone who isn’t familiar with Ray Dalio, he was the founder of what is now the largest hedge fund in the world, Bridgewater Capital, which manages $140B. One of the keys to investing Dalio attributes to his and the fund’s success is his work around asset correlation and how to match market returns with considerably less risk or volatility to the portfolio.

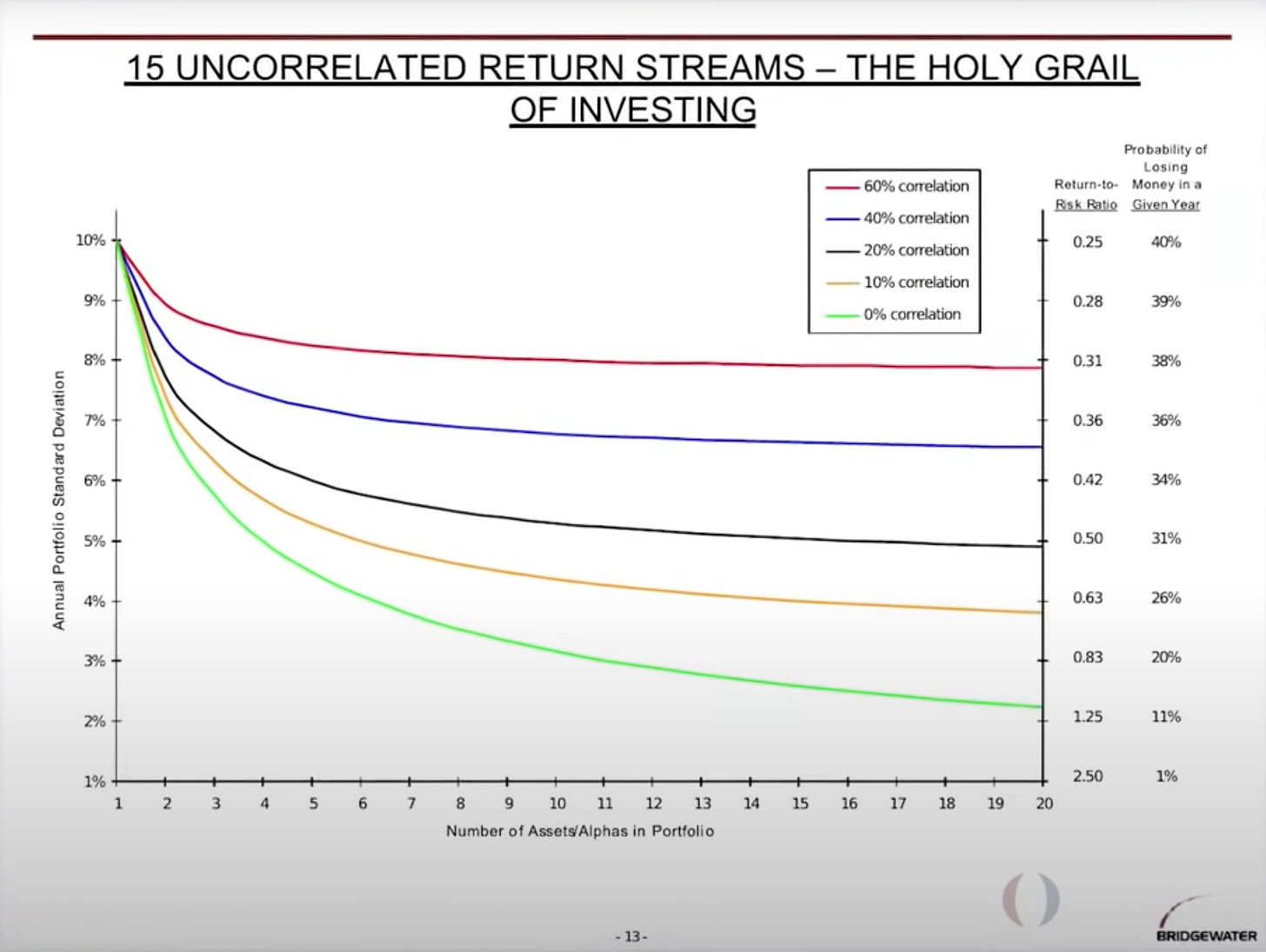

What Dalio discovered was that the risk of any portfolio is drastically reduced with every non-correlated asset you add to it, but after about 15 non-correlated assets, the reduction in risk is mostly negligible. What his “Holy Grail” also showed was that adding dozens or even hundreds of assets to a portfolio wouldn’t meaningfully reduce its risk if those assets were, say, 60% correlated.

In essence, Dalio outlined an investing methodology that allowed him to dramatically reduce the probability of losing money in any given year with just a handful of investments—each asset just had to be non-correlated to the others.

Some quick caveats to address, though: First, because there are levels to correlation, there will be levels to a portfolio’s risk. A portfolio with assets that are 40% correlated to each other will be riskier than a portfolio full of assets that are 20% correlated to each other. The reduction in risk is a direct consequence of the non-correlation, so the less correlated each investment is, the less risk to your portfolio.

The second caveat is that non-correlation alone isn’t going to ensure a solid performance out of your portfolio. Non-correlation is essential to reducing risk in a broad sense, but you still have to pick decent assets to invest in. Just because something isn’t correlated to another asset doesn’t mean it won’t underperform the market or prove to be a terrible investment.

That said, correlation is one of the most important things any investor should focus on when constructing a portfolio. Most novice investor portfolios that consist of almost entirely, if not entirely, US equities are dangerously correlated regardless of how diversified they may appear at first glance.

So do yourself a favor and make sure your portfolio is actually diversified, not just scattered across a handful of stocks, because all it takes is 15 good and mostly non-correlated investments to match the market return with significantly less risk.

Share this post