Market Reflexivity

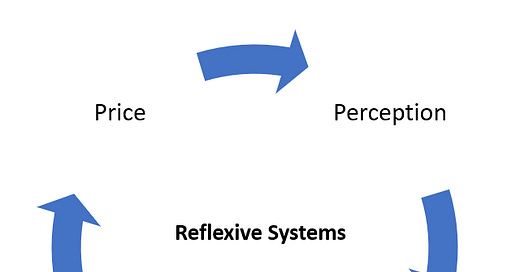

The concept of reflexivity, at least in the context of financial markets, originates with the world-renowned investor George Soros and is just his way of explaining the concept that human emotions, expectations, and perceptions have a dynamic relationship with price and fundamentals where their interaction can cause further price swings one way or the other.

Many investors will talk about price action and valuations being driven by reality and tangible things like cash flow and earnings, which is certainly part of the story, but those things only matter because investors believe they matter. The real mover of markets is investor expectations.

When investors perceive something about the market and move price accordingly, those moves can actually affect the fundamentals, which, in turn, can further affect perceptions. If, for example, the price of a stock shot up because of investor expectations, that could allow the company to raise more capital and improve its fundamentals, which could further improve investor expectations, and so on.

People often think of investor expectations or emotions as having little to no influence on fundamentals or long-term price action, but their interactions can and do feed off of each other, so both act as dependent variables heavily influencing the other and the overall supply and demand dynamics in any given market.

And because fundamentals and investor expectations are always feeding off of each other, it’s unrealistic to expect an equilibrium or fair value price. With each force constantly pushing and pulling at the other, price is always adjusting, and without an innate sense toward equilibrium, prices can’t be determined by models, the scientific method, or anything else that can’t quantify the human element of that equation.

Share this post